By Mark Anderson

Editor / Stop the Presses News & Commentary

President Trump had already said and done enough to unnerve the powers-that-be on various fronts—from hedging on free-trade deals to making bold foreign-policy strides with North Korea and Russia—when he upped the ante even more July 19, speaking out against the Federal Reserve central bank that’s seen by worshipful monopoly capitalists and their media cohorts as being too kingly for presidential criticism.

Most interestingly, in the wake of the president’s nomination of conservative Brett Kavanaugh to the Supreme Court—which the dominant political-media establishment fears will pack the court to Trump’s liking for decades to come—there also are grave concerns among those in the same crowd that the president will soon reconstitute the Federal Reserve Board to his liking to prevent further interest-rate hikes. Trump sees rate hikes as highly detrimental to his ambitious economic-growth plans, concerning jobs, infrastructure renewal etc.

On July 20, right after Trump complained that the Fed’s interest-rate increases are hurting the economy, Richard Bove of CNBC—one of many Fed apologists in the “mediasphere” who quickly leapt to the Fed’s defense—noted: “Trump will have the opportunity to fashion the central bank in the image he would like, as he has four vacancies to fill on the board of governors. The result could be a more politicized Fed.”

Bove, looking at this matter from Trump’s perspective, added:

President Donald Trump has multiple reasons as to why he should take control of the Federal Reserve. He will do so both because he can and because his broader policies argue that he should do so. The president is anti-overregulating American industry. The Fed is a leader in pushing stringent regulation on the nation. By raising interest rates and stopping the growth in the money supply, [the Fed] stands in the way of further growth in the American economy.

Bove also acknowledged:

The Board of Governors of the Federal Reserve is required to have seven members. It has three. Two of the current governors were put into their position by President Trump. Two more have been nominated by the president and are awaiting confirmation by the Senate. After these two are put on the Fed’s board, the president will then nominate two more to follow them. . . . [I]t is possible that six of the seven Board members will be put in place by Trump.

The Dodd-Frank Act’s 2010 passage increased the Fed’s power by giving it sweeping authority to regulate the banking industry. The Fed began to penalize banks that disobeyed its new rules, including determining which loans were desirable to approve and which weren’t, along with dictating how much banks could pay out for investors’ dividends. The Fed also crippled lending in the housing market. Trump, as an opponent of over-regulation, wants to rectify this situation.

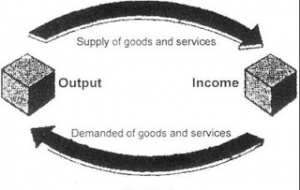

And Gove conceded what many in the alternative media, including this writer, have been saying all along: It’s a myth that the Fed overloads the mainstream money supply to cause price inflation, when, in fact, raising interest rates increases the cost of borrowing and burdens small businesses and consumers with higher debt-servicing costs for lines of credit, credit cards, car loans, some mortgages, consumer loans etc. Higher borrowing costs for businesses translates into higher prices or layoffs, as is also the case with higher energy costs, for instance. Meanwhile, higher consumer rates reduce demand for goods and services, especially when the money supply is already too low in relation to productive output.

“In the second quarter of 2018, the growth in non-seasonally adjusted money supply (M2) has been zero. That’s right, the money supply did not grow at all,” Gove wrote. “This is because the Fed is shrinking its balance sheet ultimately by $50 billion per month. In addition, the Fed has raised interest rates seven times since Q4 2015. Supposedly there are five more rate increases coming. . . . Current Fed monetary policy is directly in conflict with the president’s economic goals.”

The U.S. reportedly has the tightest monetary policy since the mid-1980s, when Paul Volcker of Trilateral Commission fame headed the Fed and caused back-to-back recessions. Retired Texas A & M economist Dick Eastman, a staunch critic of economic orthodoxy, responded to Trump’s remarks by reminding AFP that the nursery rhyme always trotted out by the media—blaming President Nixon for intervening in the Fed’s policies and “causing” the double-digit inflation of the 1970s and early 80’s—is a lie, as Volcker was behind “extreme open-market purchases of securities” (the “QE” of its day) as head of the New York Fed branch, to which he was appointed after the Nixon years. The resulting double-digit inflation would destroy the Savings and Loans institutions—competitors of the big banks—and bring about massive banking deregulation.”

“Then after that dirty deed is done, Carter appoints Volcker chairman of the Fed itself, and Volcker, having caused the inflation with his ‘QE’ in New York, tightens the money supply at the lending end, to lend less and call in loans more frequently—a tight-money regime that has pretty much persisted to this day. Of course, Volcker got credit for ‘squeezing out’ the inflation that he caused,” Eastman added.

So, while the people, especially America’s middle and lower classes, have been economically shackled for over 100 years due to boom-and-bust cycles and other disturbances wrought by the Fed’s usurious monopoly of credit, the Fed’s defenders wince at the slightest challenge to their financial fiefdom. Kevin O’Brien of the Washington Post—a newspaper headed from 1933 to 1959 by a former Fed chairman, Eugene Isaac Meyer—went hyperbolic over Trump’s remarks, scolding him for breaking “the unwritten rule against presidents criticizing the Federal Reserve.”

That remark is emblematic of the time-worn claim that the Fed must be “independent” of political influence, which really means sequestering the Fed from public oversight.

In other words, thou shalt not regulate the Fed, even though the Fed is authorized to regulate the nation, perhaps to ruin. Yet, the matter goes way beyond regulation. The Federal Reserve, which operates as a private cartel despite its “public” sounding name, is rooted in the Rothschild / Bank of England world-usury racket which hijacked the monetary system of the U.S. in December of 1913 by voiding the constitutional money-creation powers reserved to Congress. In the treacherous process, Congress passed the Federal Reserve Act but did not bother amending the Constitution to authorize the Fed’s creation and the massive transfer of monetary power attendant to that creation. Anytime such fundamental changes are made without amendment, the American republic’s authority dissolves, making the nation ripe for overthrow by private interests, in this case a banking consortium.

SEE ABOVE FOR YOU TUBE VIDEO: I addressed Trump’s comments on the Federal Reserve during my Aug. 7, 2018 UK Column News appearance.

Notably, a sound remedy for the financial stranglehold under which we find ourselves can be found at this website www.socred.org, run by Canadian author Oliver Heydorn, thanks to his insights into the “monopoly of credit” which is held over the heads of everyone. Under that monopoly, people of all racial and ethnic backgrounds are induced into duress and conflict, individually and among themselves, even as governments, in their massive indebtedness to the banking cartel, are compelled to break their covenant with the people, trash democratic principles and rule by way of deception and chronic abuses of power. The key to ending this state of affairs is to reorient the monetary system.

https://en.wikipedia.org/wiki/Social_credit

http://social-credit.com/index.html

https://www.youtube.com/watch?v=R-RwUvgtYN0 (“What is Social Credit?)

https://www.youtube.com/watch?v=ivfdcpB_fmg (“Social Credit and the Christian Ethic” by Norman F. Webb 1937)

https://www.youtube.com/watch?v=NdcVuf8ajxc (Robert Klinck – “Economists’ Failed Professionalism” – 2016)